Whoopie ... I've

Gone Solar !!!!

Say good-bye to electric bills.

Hi, My name is Richie

Schecter. I am not affiliated with any solar company.

I created this website both to educate you about how solar

panels work and the benefits of PURCHASING panels.

My panels are not leased, though that is an option, which I

chose not to do.

MY

TOTAL PAYMENTS FOR ELECTRICITY FOR EACH

"YEAR" HAVE BEEN ABOUT $200

(about $15 a month ... more or less)

and that is the basic charge from the Electric company plus

taxes.

In addition,

the best time for putting solar panels on your roof (in my

opinion)

is right after the summer when you are accumulating energy

credits to use during the summer

months.

SEE BELOW FOR DETAILS

THE FIRST QUESTION EVERYONE ALWAYS ASKS IS

..."What is the cost?"

The simple answer depends on the amount of electricity you

require

and if you want to completely eliminate your electric bill

or just reduce it.

But like anything else, there are other factors that are

involved. So "READ ON"

WHAT I WAS PAYING to NVEnergy ...

$213 per month on balanced billing.

Tentatively to be increased to about $217 a month beginning

Jan.1, 2015

ELECTRIC USAGE - about 17,000-18,000 watts per year.

|

Here's

my story ...

I have just had installed

an 8.5 KW micro-inverter system consisting of 34

Trina Solar Panels each being 250w.

Trina Solar is one of the world's leading PV

(Photovoltaic Cells) companies.

VERY

IMPORTANT ... PLEASE NOTE:

There are many factors involved in cost such as

solar panels selection, amount of panels

required,

type of system you select, method of payment (cash,

financing, down payments, etc.)

In addition, there may or may not be special deals

at the time. I have supplied my own information

because most people have no idea how much solar

panel systems cost. No two systems will be

alike.

Yours will be higher or lower in price than mine

depending on some of those factors.

|

UPDATE:

I have been on Solar for more than two and

a half years. My total bills for "each

YEAR are about $200

If

the PEC program winds up returning more

money to me, I could receive up to another

$1000.

MY COSTS

Gross cost =

$34,925

Then I receive Federal Tax Credits (30% of

total cost $34,925 x .30=$10,477.50)

So Deduct $10,477.50 (but at tax time, not

at first)

$34,925 - $10,477.50 =

$24,447.50

*

Tax credits are deducted from your income

tax at tax time.

You do not have to use all of them in one

year. You can use them over a 4 year

period.

Note: The credit has no limit and will be

available through December 31, 2016.

So

my total Cost "after" tax credits

is

$24,447.50

Since I am saving about $2000 each year,

it should take about 10 years to pay off

the panels. And every year after that I

will be saving $2000.

Note:

Installation of Solar Panels is tax exempt

from Property Taxes. So the value of your

home increases but the solar improvements

are not taxable!

Most

solar companies have financing

plans. There is even a way to pay the same

amount you are paying NVEnergy. Instead,

you would be paying the solar company for

the Solar installation over time. Once

paid off, you should be finished paying

for electricity2 and you will

no longer be subject to electric rate

increases (assuming your lifestyle remains

the same and you don't go crazy adding

high power electrical

items).

|

=========================================================

More info:

There are other ways you may get back

money

First

... PECs (also known as RECs) ...

Portfolio Energy Credits or Renewable

Energy Credits.

PLEASE NOTE that this program while

still in existence may not always be

there. Solar installing companies do not

want to raise costumers' hopes and

expectations about PECs, but right now the

program exists and hopefully will last for

a long time.

So WHAT ARE

PECs? ... also called RECs in many states

- Nevada's Renewable Energy producers can

earn PECs, which can then be sold to

utilities that are required to meet

Federal or State government portfolio

standards. One PEC represents one

kilowatt-hour (kWh) of electricity

generated. This means that for every 1000W

you generate, you receive one PEC

certificate.

Here's an example. My system

produces 17000 kw. So I would receive 17

PECs. Each PEC right now is worth about

$30. So 17x30 is $510.

PECs

may be sold in California (with

restrictions), Colorado, Kansas, Missouri,

N.C and Oregon (with restrictions).

Second

... Many companies pay you for Referrals -

approximately $300 to $500 per household

for referrals that install solar panel

systems.

During those 10 years, if I had done

nothing, I would have paid A MINIMUM of

$25,560 to NVEnergy and most likely much

more since the rates will continue to rise

and "would have continued to pay

forever!"

My Solar System

increases value of my home $35,000 but is

tax exempt and "does not increase property

taxes!!"

|

SUMMARY

(looking

ahead 7 to 10

years)

If I had

done nothing, in

the next 10 years I'll have paid NVEnergy

$25,560-$30,000

and

continue

to pay this amount or

more as electric rates

increase.

Instead,

I paid my solar company $24,447.50 and I

OWN the Solar

Panels.

Electric rates will have risen, but I

will be producing my own electricity,

so my electric bill will be

non-existent.

Additional monies may come to me via

the PEC program.

My electric bill

instead of being $2556 a year or higher,

will now be about $200 a year and that is

simply the basic charge plus

taxes.

Assuming I had

done nothing, I would have continued to

pay NVEnergy $213, $230, $250 or whatever

their current rate may be for as long as I

own my home and that would be worth at

least $25,000-$30,000 every ten

years.

My home value will

have increased making it more desirable

for a potential buyer. Assuming two

identical houses are for sale, and one has

a $250 electric bill each month, while the

other has no electric bill, which do you

think the buyer would choose?

|

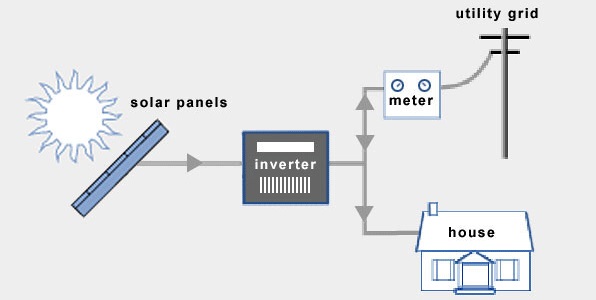

What is the difference

between

"Off the Grid" and

"Grid-Tied"?

MOST HOMES (including mine) ARE

"GRID-TIED"

Click on the picture above

--------------------------------------------------------------------------

2

Minimum payment of $10.50 to NVEnergy to stay

linked to grid. But that would be offset by

just

one referral. "Each" one will eliminate that $10.50

for at least 2 1/2 years!!! and of course, don't

forget those PECs!

I've had two referrals on the first

day!!

How

Solar Works

We

can change sunlight directly to

electricity using solar cells. Every day,

light hits your roof's solar panels with

photons (particles of sunlight). The solar

panel converts those photons into

electrons of direct current ("DC")

electricity. The electrons flow out of the

solar panel and into an inverter (or each

panel can have a micro-inverter) and other

electrical safety devices. The inverter or

micro-inverter converts that "DC" power

(commonly used in batteries) into

alternating current or "AC" power. AC

power is the kind of electrical that your

television, computer, and toasters use

when plugged into the wall

outlet.

A

net energy meter keeps track of the all

the power your solar system produces. Any

solar energy that you do not use

simultaneous with production will go back

into the electrical grid through the

meter. At night or on cloudy days, when

your system is not producing more than

your building needs, you will consume

electricity from the grid as normal. Your

utility will bill you for the "net"

consumption for any given billing period

and provide you with a dollar credit for

any excess during a given period. You can

carry your bill credit forward for up to a

year.

|

|